With your company's cash, you can't afford to take any risks. You're simply operating blindly if you don't have a complete picture of your company's financial health. You must have a clear overview of your business in order to make strategic judgments. An accounting system is critical for guiding operational decisions and for a company’s growth. It also helps to simplify financial matters in your company. But, the first and foremost question is, what is an accounting system? Secondly, how do you know you've got the correct ERP accounting system according to your requirements?

An accounting system is a piece of software that assists organizations in tracking. It also helps in managing financial transactions as well as makes accountants' jobs easier. These automated ERP product help simplify business procedures and activities such as sales, purchases, assets, and general ledgers. Most companies perform these activities manually. An accounting system enables you to create scalable financial strategies for your firm. It also provides accurate analytical services. Businesses can keep track of their whole financial picture. They can track every transaction, from income to cash balances to accounts payable and receivable, with a single centralized system.

Accounting software is also useful for creating financial reports, which are an important part of running a firm. Particularly when you need to make a choice. In manual procedure, every employee had to do all financial activities and journal entries by hand. The only automated solution, which you can access from anywhere, allows you to enter, modify, and evaluate data. The company's ERP accounting system is considered one of the best automated ERP Solution to handle a company's financial transactions.

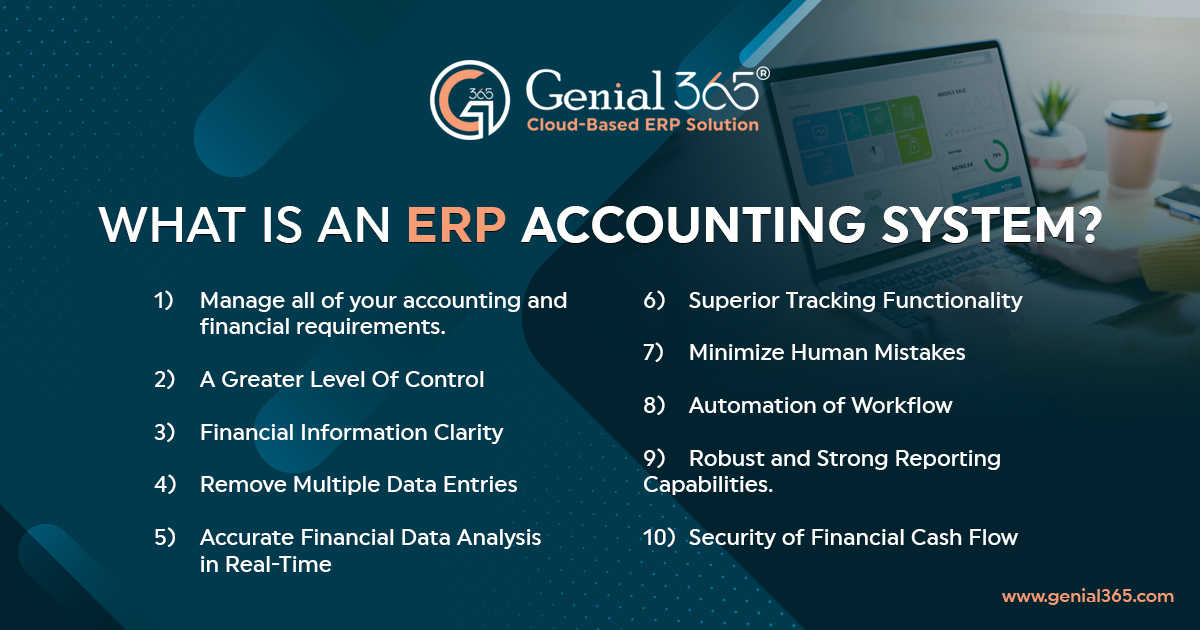

An ERP accounting system is essential in modern businesses. It also improves efficiency, automation, and simplification of corporate operations. ERP accounting systems assist businesses in streamlining the accounting process through data integration. It also offers a clear perspective of the organization and allows business owners to make rapid, educated choices. ERP software is much more powerful than a standalone accounting system for handling a company's accounting and finances. It allows you to coordinate and track cross-organizational processes using a single platform.

The ERP accounting system helps to manage accounting and finance thoroughly. Every organisation must properly and actively manage cashflows, which is made much easier with an ERP accounting system module. It allows you to build a budget and allocate financial resources for various objectives. These objectives include raw material purchases, marketing campaigns, staff pay, transportation, and several other operational expenditures. Having a unified system to manage numerous processes or departments saves time. It also helps to save money by eliminating the need to buy separate tools for each. In a summary, companies can do the following:

● Estimate capital requirements and manage cash flow.

● Prepare a precise budget.

● Costs for various activities should be allocated.

● Organize payments to vendors, workers, and other parties.

One of the most significant advantages of the ERP accounting system is that it gives you greater authority and control over your company. You can also see how actions and events affect your bottom line in real time. You can also keep improving your decision-making in this way, lowering costs, increasing profits, and encouraging growth.

Accounting ERP allows you to access financial data anytime you need it. The ERP system's goal is to offer accurate and dependable data in a timely manner. As a result, the organization's resources are utilized and business operations are well organized and controlled. It gives you a 360-degree perspective of your financial data, and this insight is invaluable.

The ERP accounting system helps businesses nowadays to automate and manage their company's operations. The ERP accounting system integrates all the financial modules. As a result, it eliminates the hassle of comparing and validating data across several systems. It also eliminates duplicate entries and records to eliminate confusion. As a result, it greatly improves the consistency of data.

Accounting and financial ERP systems provide deep, comprehensive visibility of the business. It also provides a real-time report of the financial health of the entire organization across departments. The system ensures that you may monitor your organization's economic health effectively and clearly. It also helps you to regulate spending, measure revenues, and handle other accounting process operations. It ensures that you are fully informed of any cash activities as they occur.

One significant advantage of the ERP accounting system is that it helps with all the comprehensive financial transactions. It also helps to improve tasks connected to finance and accounting. These tasks include credit management, revenue monitoring, client payment schedules, and much more. Accounting ERP helps to manage high-track abilities like Pay payments, Revenue, and Billing. The ERP Accounting management system also enables you to keep track of your company's profits, budgets, cost analysis, invoicing, and so on.

There is always a chance of a mistake or wrong entry if the data input is done manually. It can also create dullness, causing the individual to lose focus and press the wrong keys. While such mistakes are very common, faulty or missing accounting data can have a severe influence on the accuracy of financial reporting. As a result, it leads to even more problems and, in some cases, complications in tax computation. The accounting ERP management solution detects and corrects data entry errors, reducing the chance of creating wrong invoices. It also keeps monitoring payments for improper amounts or experiencing other accounting difficulties as a result of data entry errors.

Accounting management ERP contains time-saving tools and also built-in processes. These time-saving workflows help to automate your accounting and speed up the data entry process. It also enhances financial management and eliminates cash flow issues. It helps to simplify complicated accounts payable and receivable procedures. With the Accounting ERP system, you can simply acquire, track, and analyze financial data from many departments. Income reports such as balance sheets and statements of financial position may also be generated. All of this automation makes it quite simple to collect data from throughout the organization and utilize it to better run your business.

Accounting departments spend a significant amount of time generating financial reports for various stakeholders. These reports are related to banks, tax authorities, shareholders, and so on. Accounting management With its powerful reporting functions, ERP helps to eliminate all of this repetitive and hectic work. Its built-in filters may be adjusted and used to meet the particular needs of various organizations. As a result, it provides accurate and complete financial reports.

Financial data requires a high level of security standards for data protection because of its highly private nature. The Accounting ERP system provides many levels of security, with tight standards in place for databases that contain information. It provides only role-based access to users who must use multiple authentications to gain access. As a result, accounting ERP software is capable of preventing security problems and safeguarding sensitive financial data.

ERP accounting software is designed for all types of users. However, it is still critical to make sure that the system of your choice is user-friendly, accessible, and operable by everyone. It has included individuals who are not experts in accounting or technology. Furthermore, the software of your choice must be capable of adapting to the demands of your business. When employees struggle to use the accounting system, the organization is more likely to make mistakes. Software that is simple to use and comprehend can help you manage your staff and business more effectively.

When operating a business, you must have rapid and efficient access to data in order to make critical choices. Because all data and information is encrypted and securely kept on the server, you may access your essential financial information at any time and from any location.

The most important aspect of good software is accuracy. To be consistent with the time and investment made, the accounting system must maintain accurate data. It should also have up-to-date balances in individual accounts and ledgers. Differences of opinion may occur as a result of database failures or server issues. Nonetheless, a competent accounting system must detect and repair flaws that may result in data inconsistencies.

To summarise, ERP accounting software is a tool that enables company employees to easily handle specific firm financial operations and automate other financial duties. Always choose the right accounting ERP that should be customer-centric and an end-to-end solution provider. Furthermore, it should assist businesses in accelerating fast growth, delivering maximum value, and increasing efficiency by focusing on the customer. As a result, selecting the correct software may help financial managers be more productive at work.